If companies stick to their plans, sodium batteries are likely to hit the market this year.

The chemical alternative in the battery industry

Lithium aside, a new chemical compound has emerged that will displace you from the battery throne.

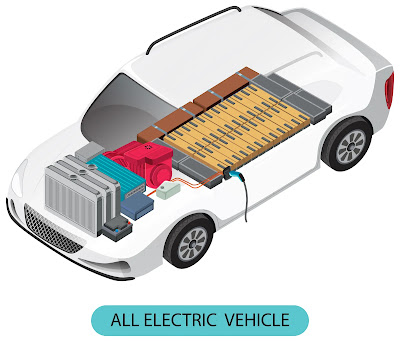

Lithium is the most important material in the world of batteries at the present time, as it is a key component in the manufacture of batteries that provide energy for phones and electric cars, and which are even used to store energy in the electric grid.

However, as concerns about battery supply chains grow, scientists are working on new ways to mitigate the use of the most expensive and least-available key components of battery technologies. Researchers have come up with several options to reduce the need for some of these materials, such as cobalt and nickel, but have been unable to make much headway in their quest to eliminate lithium.

However, over the past few months, several Chinese car and battery makers have announced achievements related to a new type of battery chemical composition that is based on sodium rather than lithium. These new sodium-ion batteries could help lower the costs of making batteries for stationary storage and electric cars if the technology can live up to the companies' ambitious expectations.

A promising lithium-ion battery substitute is sodium-ion batteries

In March, the Chinese company JAC Motors published pictures of a yellow-green car, which it said was the world's first electric car based on sodium-ion batteries. The small car is equipped with a 25 kWh battery made by another Chinese company, HiNA Battery, and according to the company's press release, the vehicle has a range of up to 250 km. In April, China's largest electric vehicle battery maker, CATL, announced that it had made a sodium-ion battery and plans to launch it in an electric car produced by automaker Chery. None of the four companies responded to our request for comment.

"They make very interesting statements," says Andy Leach, an energy storage systems analyst at BloombergNEF (BNEF), "but they also lack a lot of detail." Neither Cattell nor Hina has released any production dates or detailed battery performance metrics, nor have they even disclosed the specific types of sodium-ion batteries they plan to use. But this ambiguity is not uncommon for these large companies. On the other hand, this ambiguity raises questions about the ability of sodium-ion batteries to perform well when used in real cars.

Disadvantages of sodium-ion batteries

Sodium-ion batteries are not new, but they had shortcomings that made them unable to match lithium batteries. According to Shirley Ming, a battery researcher at the University of Chicago and the US Argonne National Laboratory, traditionally designed sodium-ion batteries lose their efficiency quickly, they nonetheless have a lower energy density than lithium-ion batteries.

This means that the sodium battery would have to be much larger and heavier than the lithium battery to store a similar amount of energy. For electric vehicles, this results in reduced vehicle range when using a battery of the same size.

A heavier, cheaper battery may be better for some uses, such as some of China's smaller, shorter-range electric cars. The range announced by JAC is equivalent to the Wuling Hongwang Mini, one of the most popular electric cars in China, whose long-range model can travel up to 280 kilometers on a single charge.

It may be easier to market sodium-ion batteries in the market for stationary storage equipment, such as those used to provide backup power to homes or businesses, or on the public electrical grid. Some companies, such as the American company Natron, are developing batteries with a chemical composition intended for stationary use models, where size and weight become less important than in the case of a moving car.

Beginning more than half a century ago

Ming says that the development of sodium-ion batteries began more than half a century ago, and their performance has steadily improved, with the past decade, in particular, witnessing great leaps. Battery researchers have been able to solve some of the previous problems with battery life, and these solutions rely in part on electrolytes (plural of electrolyte, the liquid that helps transport charges in the battery) with compositions more compatible with the electrode materials used in sodium-ion cells. In addition, the researchers also developed better materials for the electrodes of the batteries, which helped increase their energy density.

But the real reason for the sharp rise in the popularity of sodium-ion batteries is attributed to the increasing pressure on lithium mines and lithium processing facilities to meet the growing demand for electric vehicle batteries.

The world will not run out of any of the materials needed to manufacture the infrastructure for electric vehicles and renewable energies soon. Stockpile estimates indicate that the Earth's crust contains enough lithium for billions of electric cars. But creating the infrastructure needed to extract lithium and other materials from the ground and process them for use in making batteries has become more difficult than ever. In most places in the world, building a new mine would take about a decade.

Lithium is abundant in the Earth's crust, so why replace it?

The demand for lithium witnessed a sharp increase due to the growing interest in electric cars, as it accounted for 13% of global car sales in 2022. The increase in demand led to a sharp increase in prices, as the price of lithium carbonate, which is one of the materials used in batteries, almost tripled between November 2021 and November 2022 before it starts to drop again.

Both the fluctuating price of lithium and the ever-increasing demand has opened the way for other chemical combinations, Ming says. "I think sodium is a good alternative to take the pressure off lithium," she says. Unlike lithium, sodium can be produced from an abundant substance, salt. Since raw materials are cheap and plentiful, sodium-ion batteries are likely to be much cheaper than lithium-ion batteries if companies start making more of them.

However, if market conditions open up the space for alternatives to lithium, they could just as easily close the field. The fate of sodium-ion batteries is likely to be “directly linked to the cost of lithium,” says Jay Whitaker, a battery researcher at Carnegie Mellon University and former founder of sodium-ion battery company Aquion.

If sodium-ion batteries enter the market due to cost issues and material availability, lower lithium prices could jeopardize their position. It's hard to make a new kind of battery, Whitaker says, and it's hard to make it on a large scale. It is even more difficult to keep up with the ever-improving lithium-ion batteries, whose cost is dropping day by day.

Sodium will probably end up in electric car batteries in China by the end of this year, but this technology probably won't be able to displace lithium. Instead, the battery world is likely to witness more branching and diversification, as companies continue their work in developing more different options of batteries suitable for different situations. The battery market is full of what Whitaker calls “holes and nooks,” and sodium-ion batteries may eventually find their place there eventually.

Comments

Post a Comment